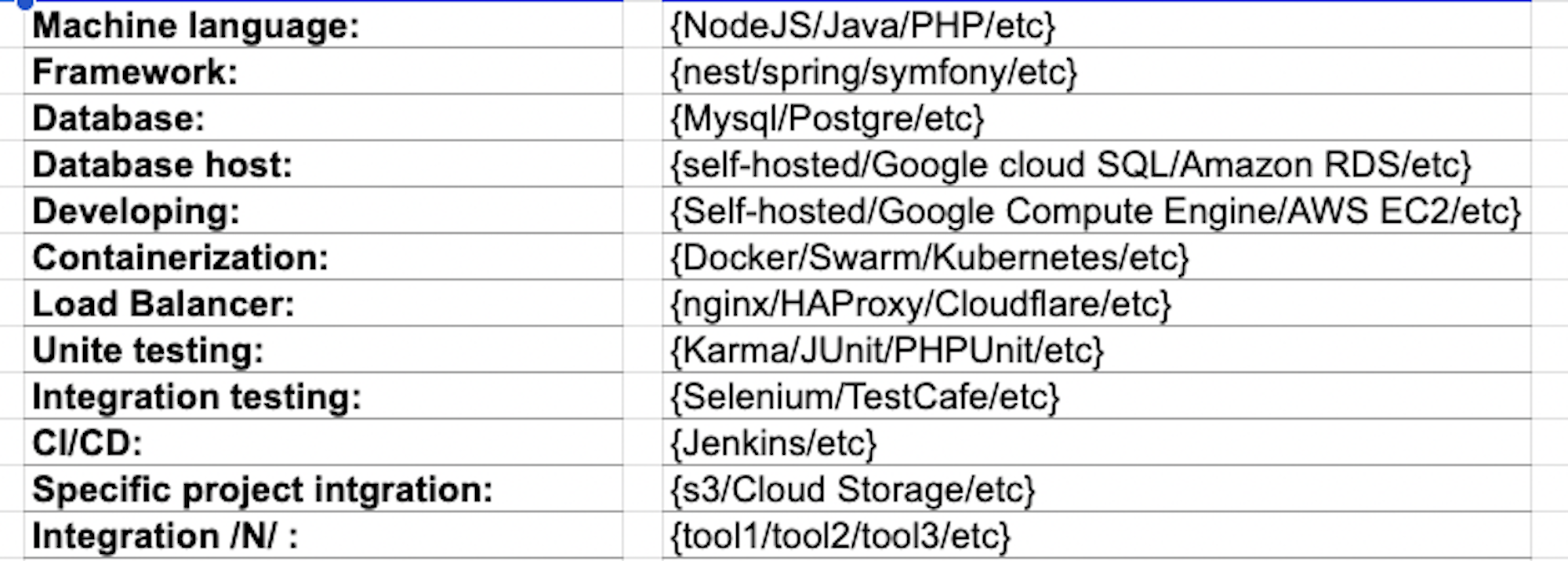

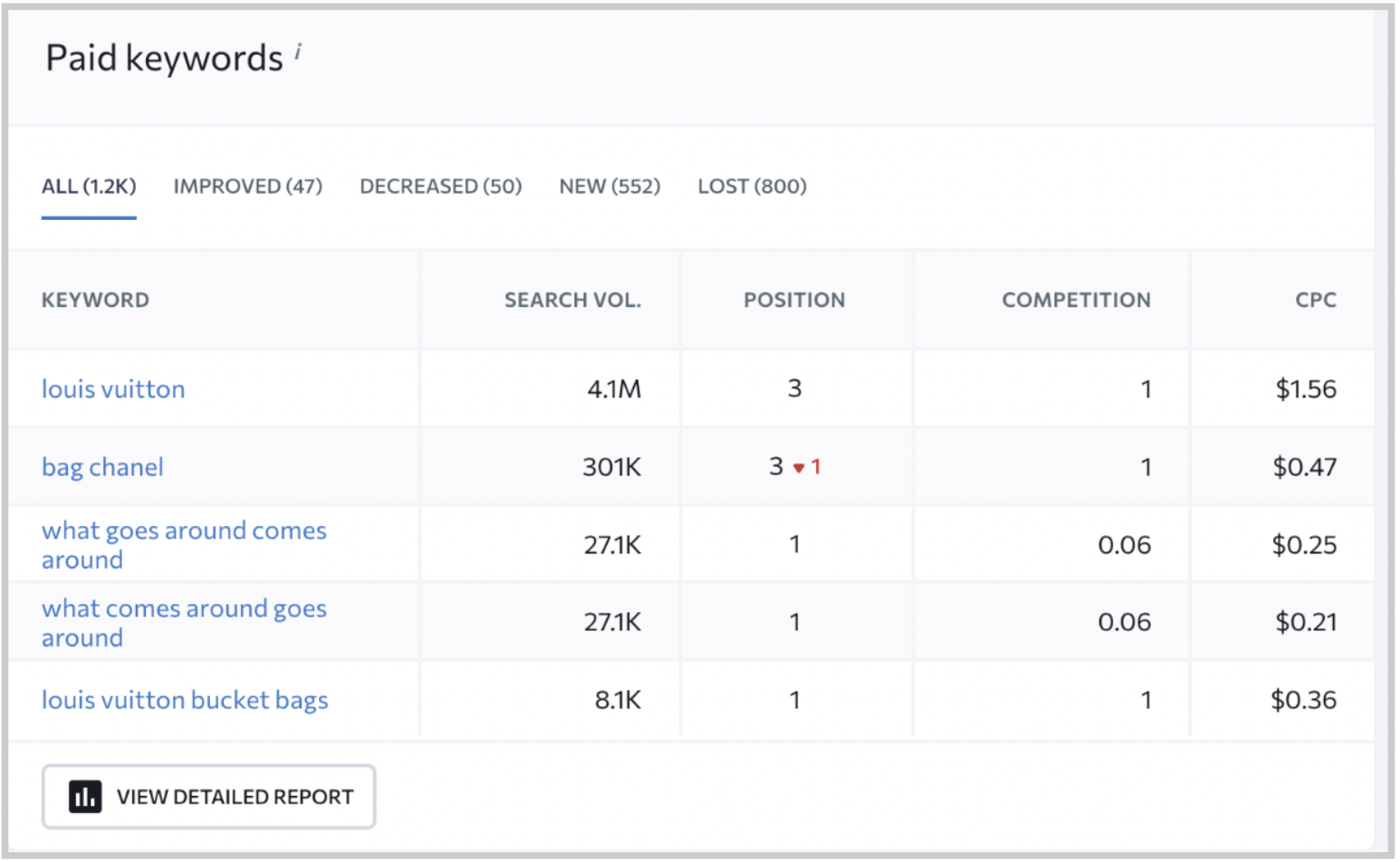

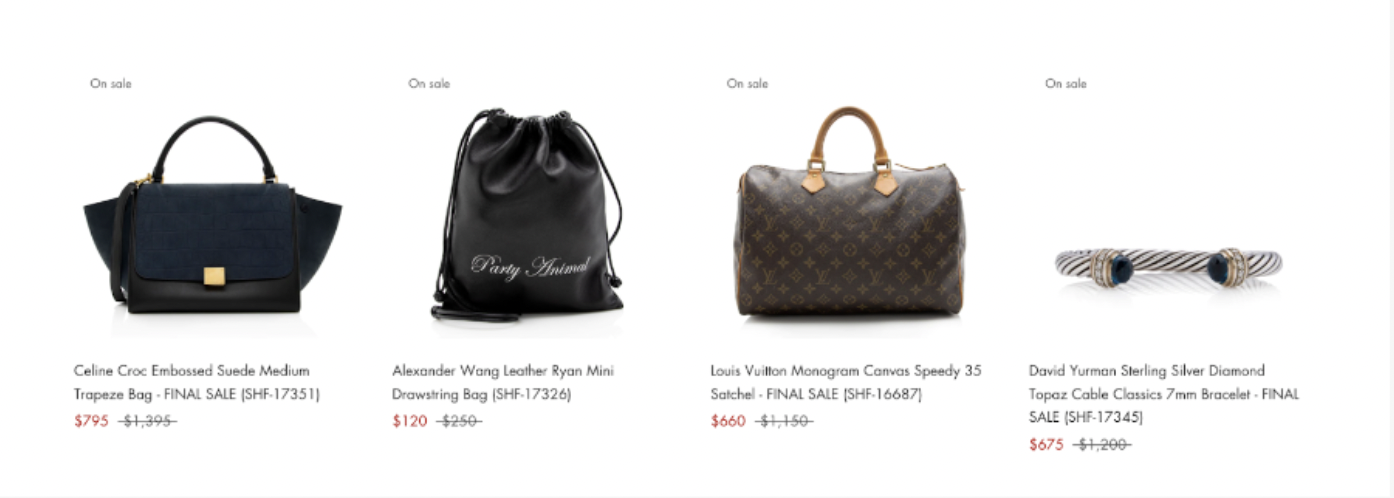

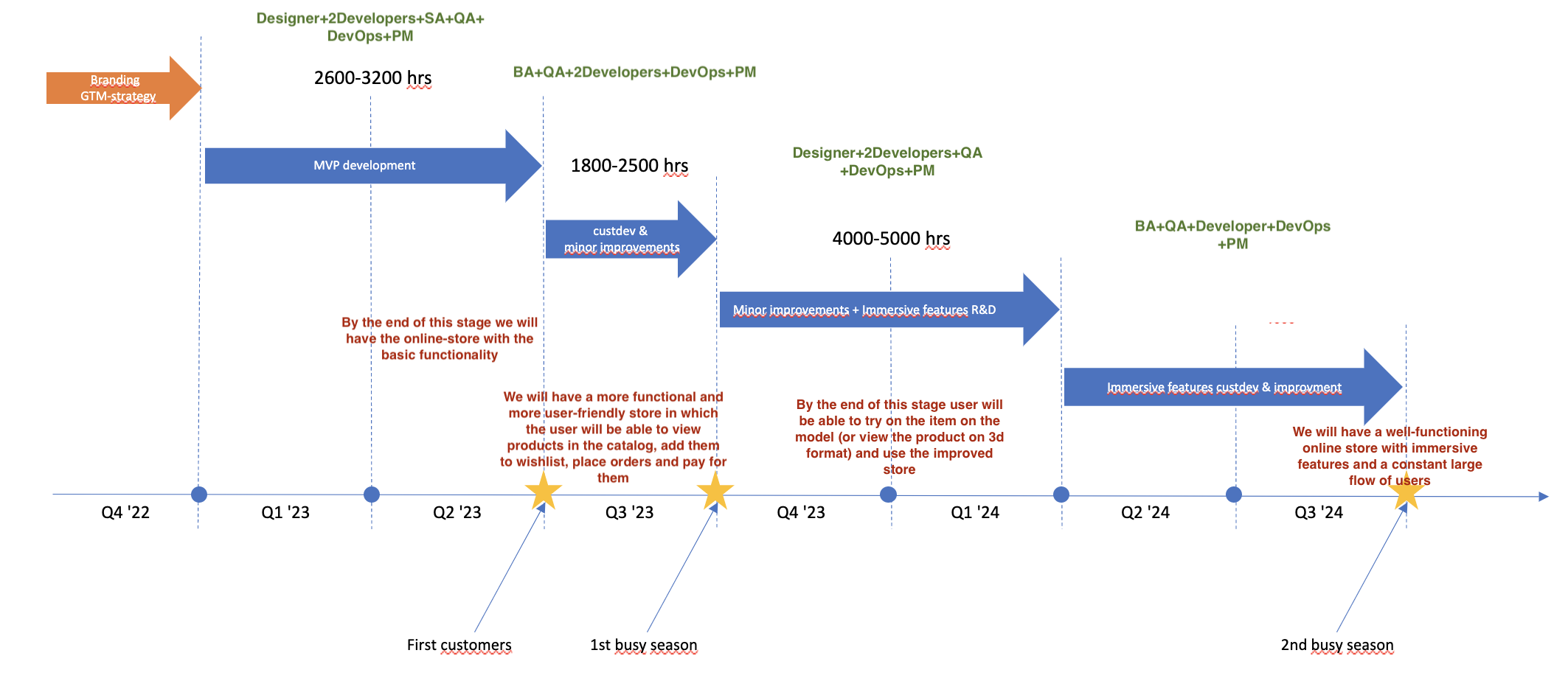

An established luxury resale company, known for specializing in luxury bags and accessories for over two decades, aimed to establish its own brand beyond selling on marketplaces like TheRealReal.com and eBay.com. The company aimed to launch independently online leveraging emerging technologies to extend its market reach.

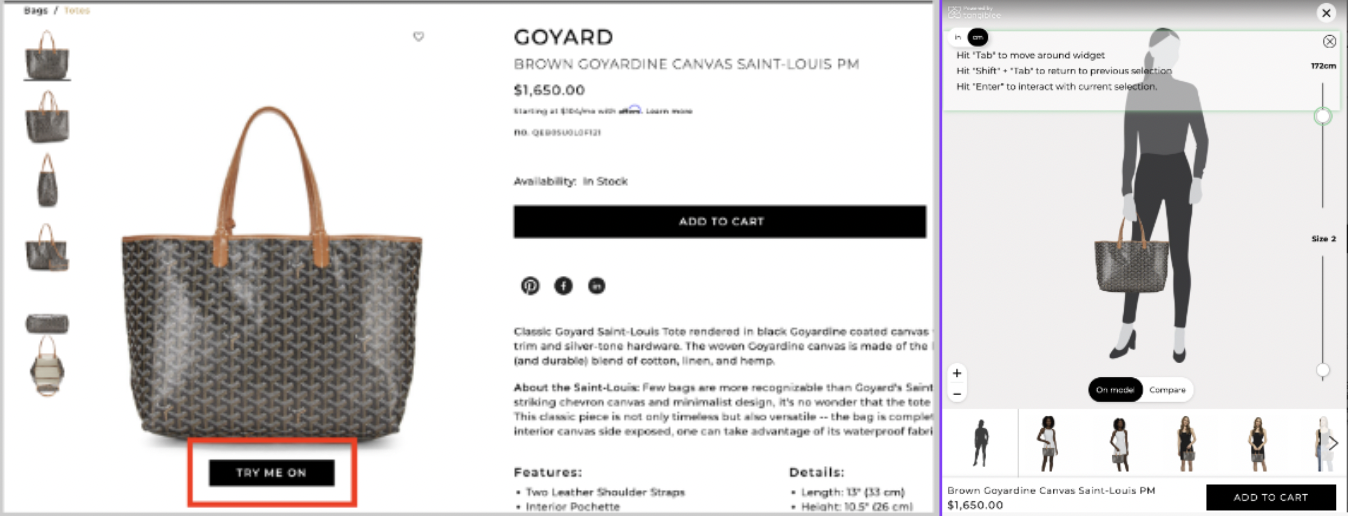

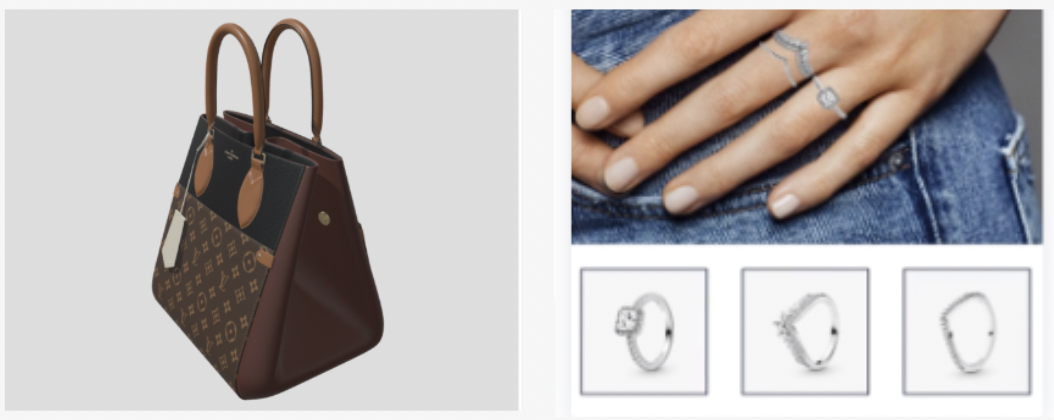

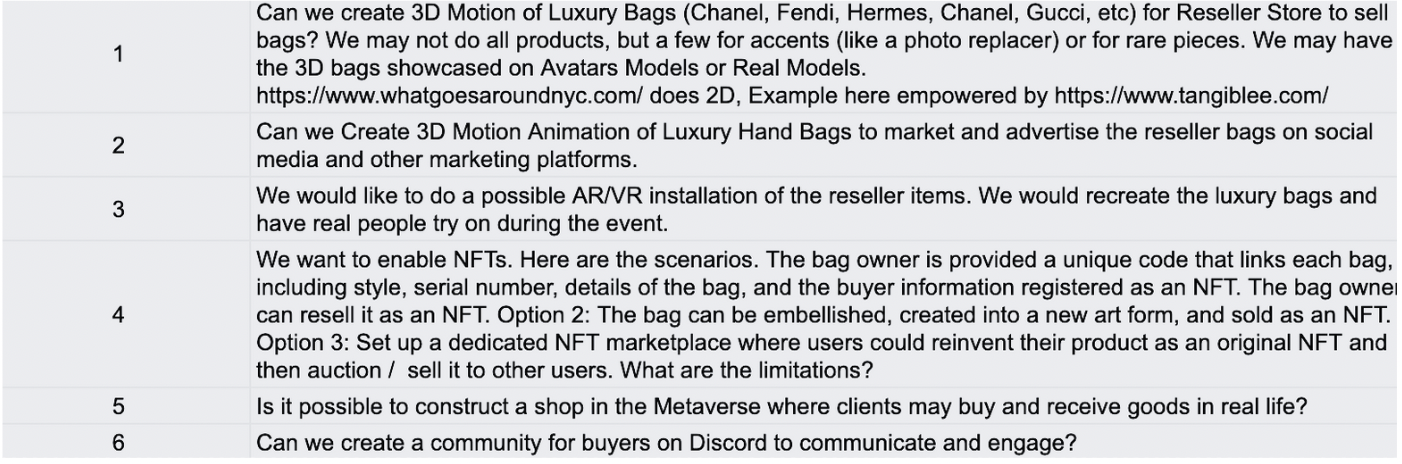

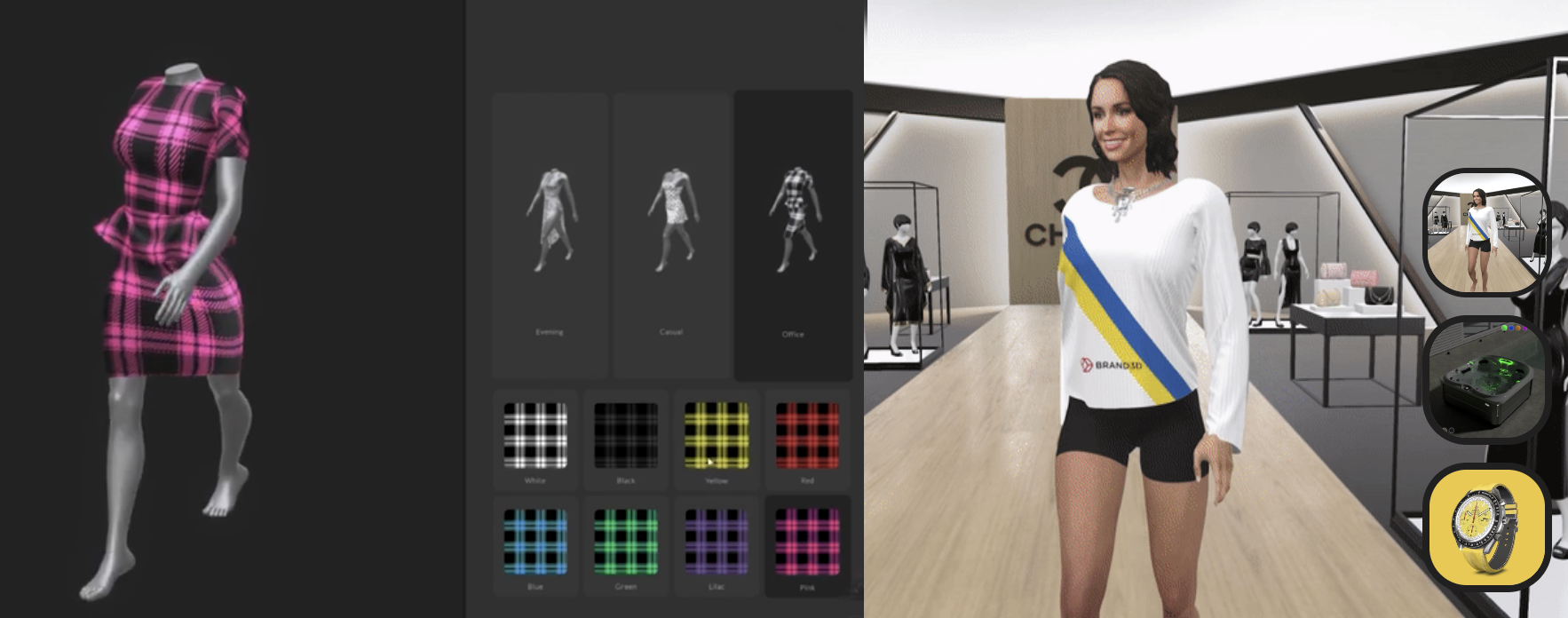

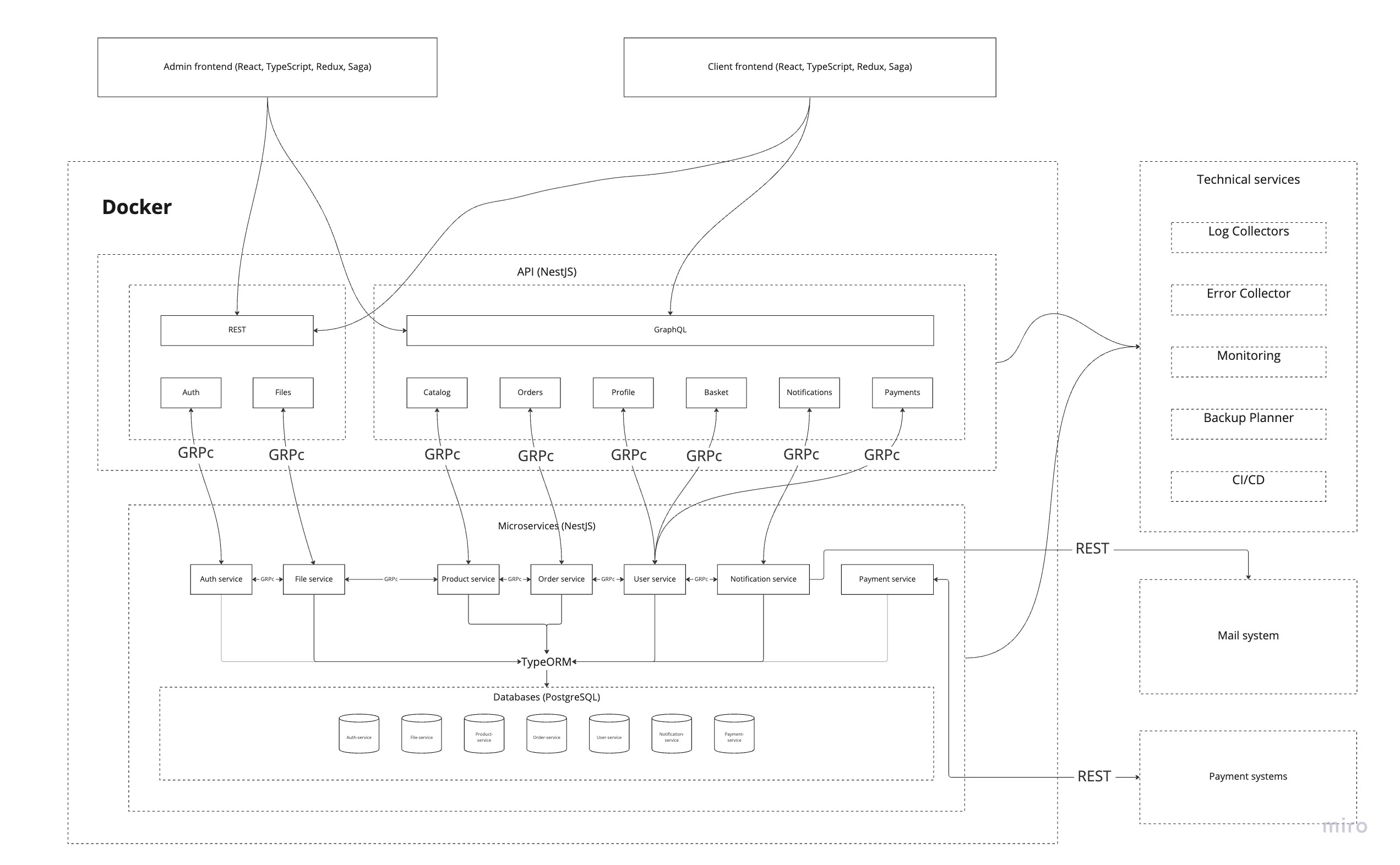

The plan involved designing and developing a bilingual (English and Chinese) D2C custom e-commerce shop that would showcase and sell pre-owned luxury bags and accessories. The platform would feature innovative 3D motion graphics and customized avatars replicating the customer’s body size, integrating Web2 capabilities with Web3 animations to create an immersive shopping experience.

This initiative to create a 3D-enabled commerce platform would position the luxury resale company as one of the first in the industry to offer an immersive shopping experience in Web3 and the Metaverse.