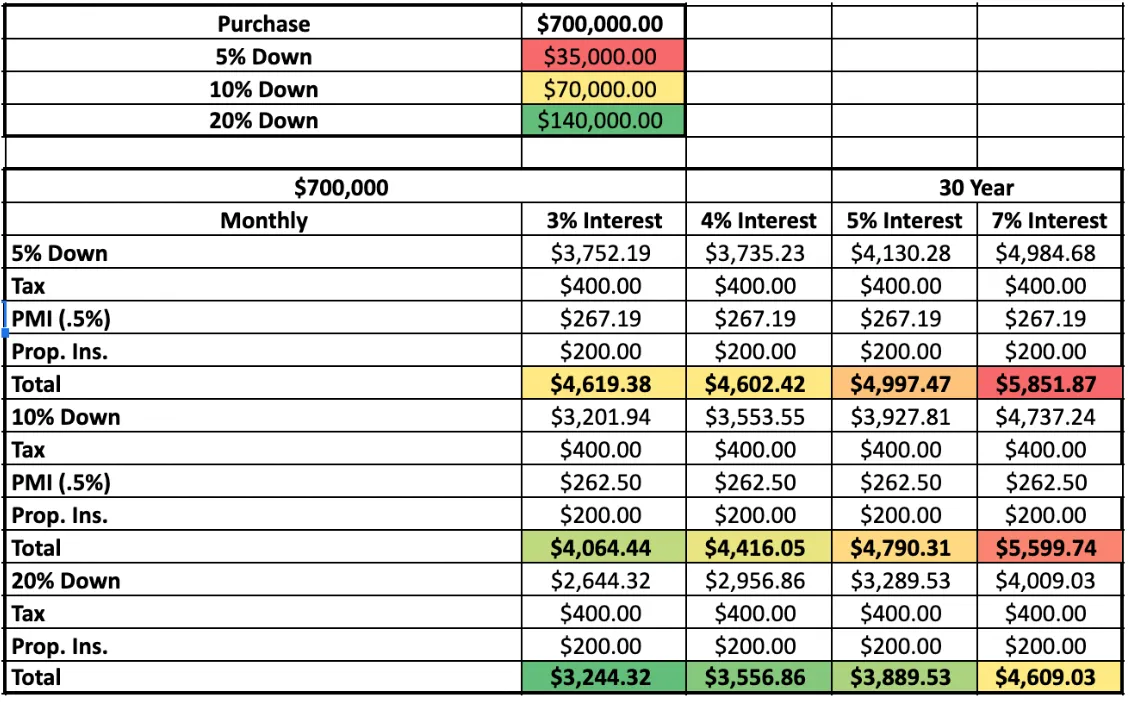

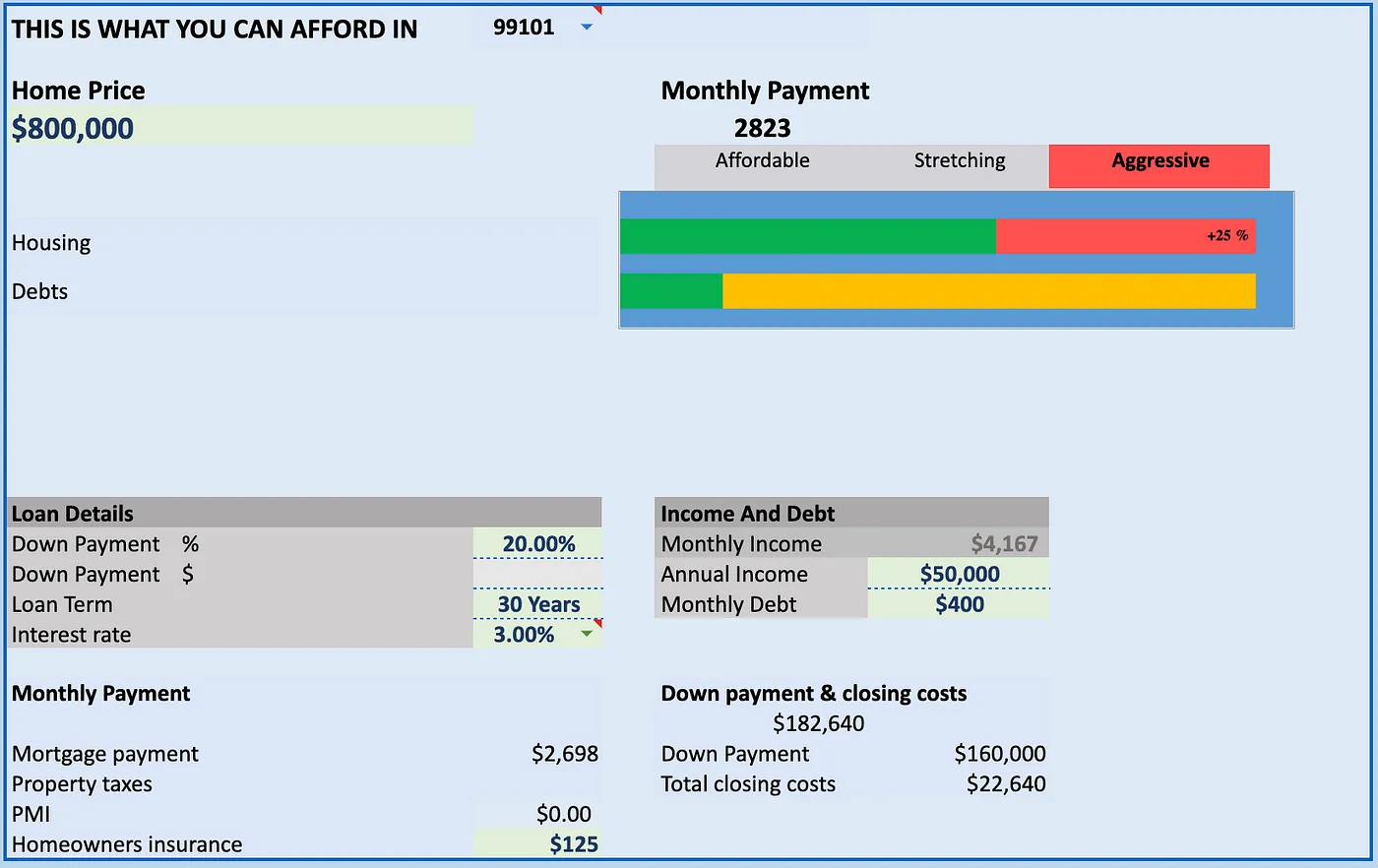

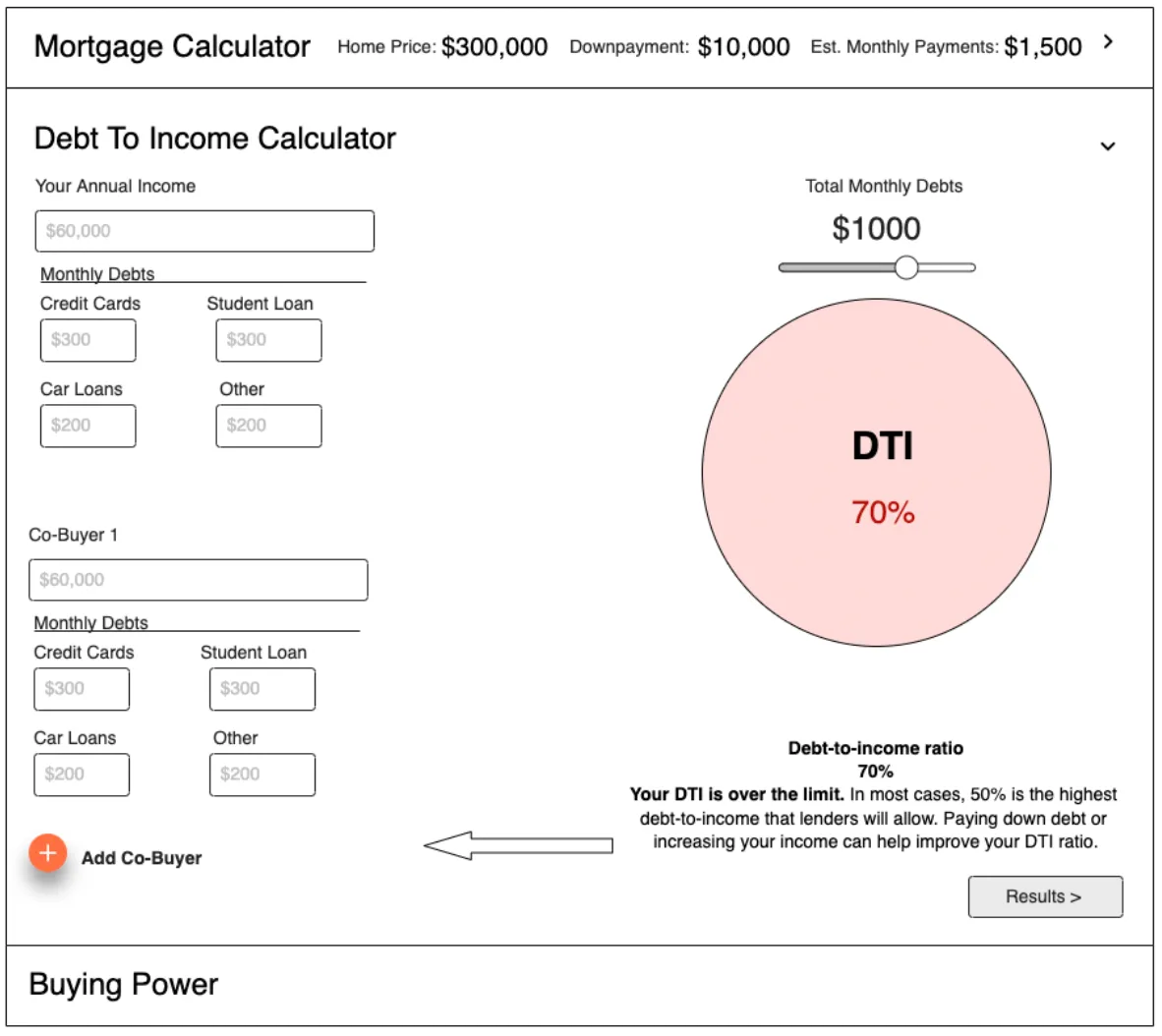

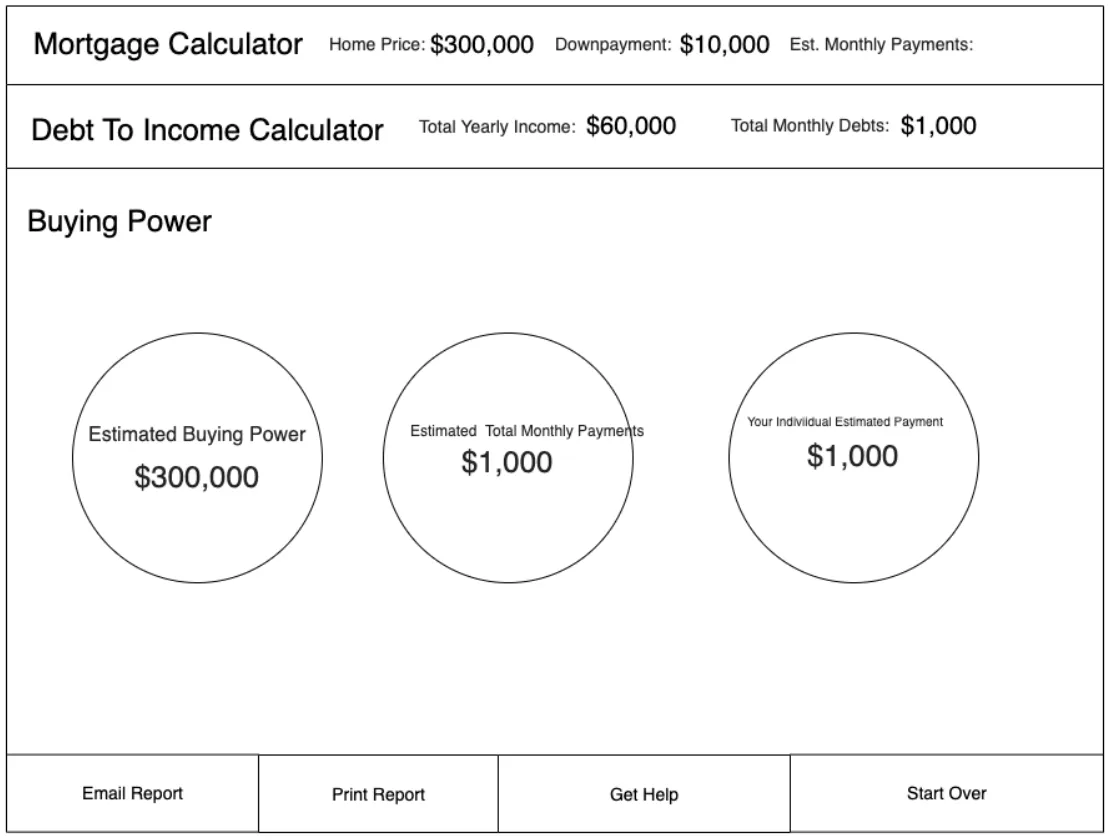

Pairgap simplifies the home co-ownership process for multiple buyers, making homeownership and real estate investments accessible to millennials and Gen Z by splitting costs on properties.

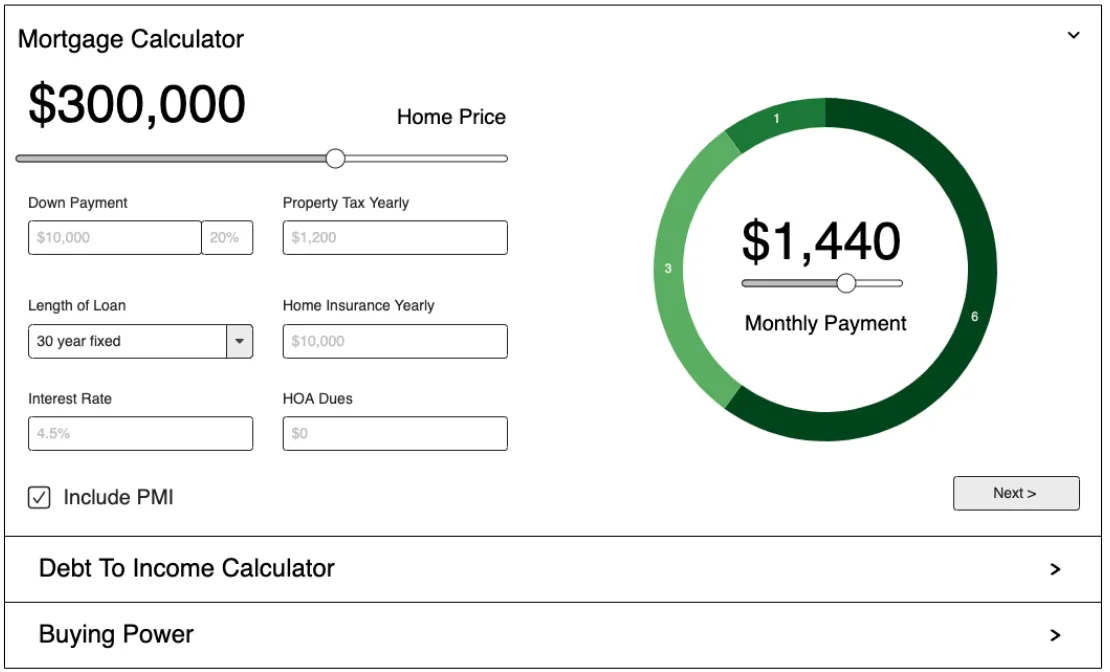

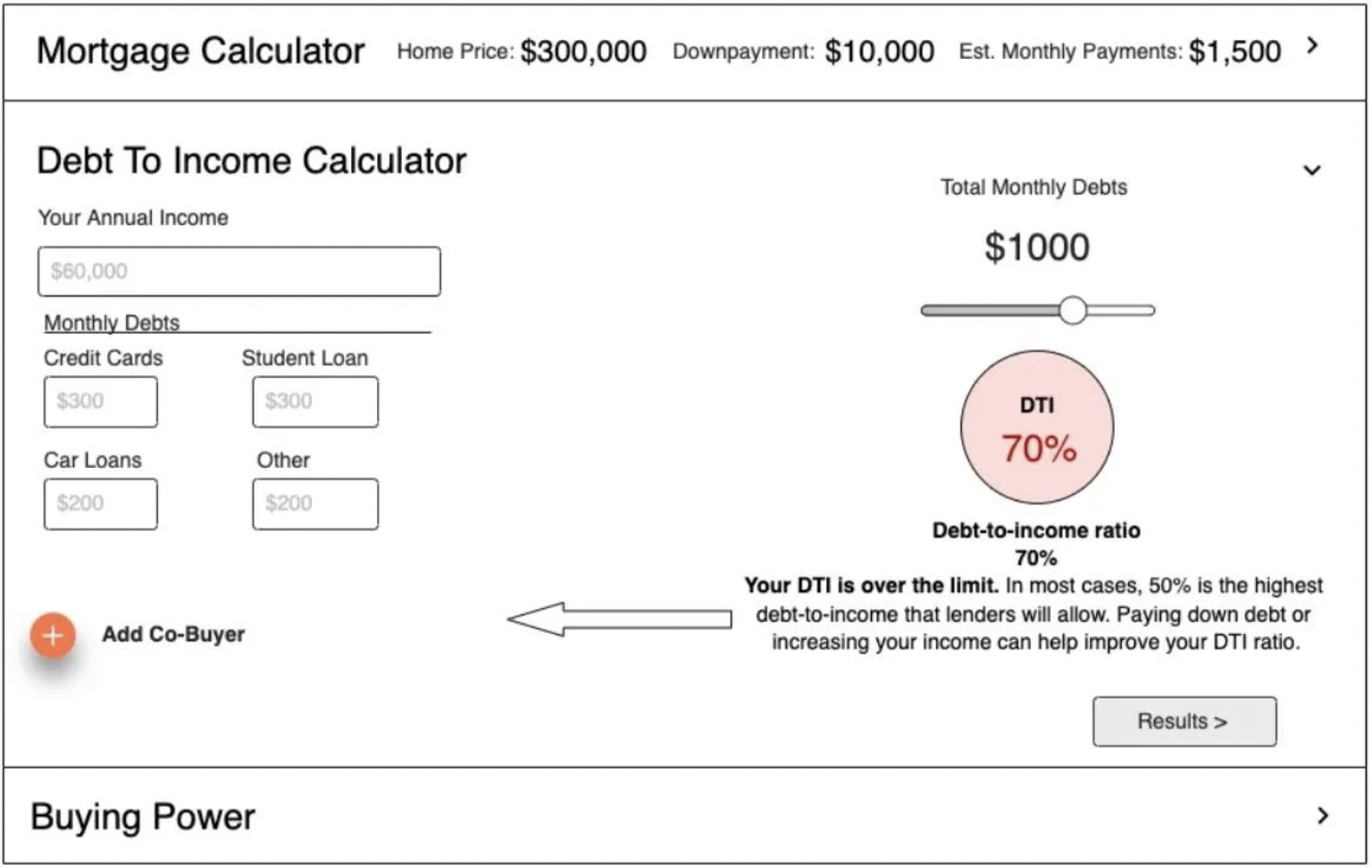

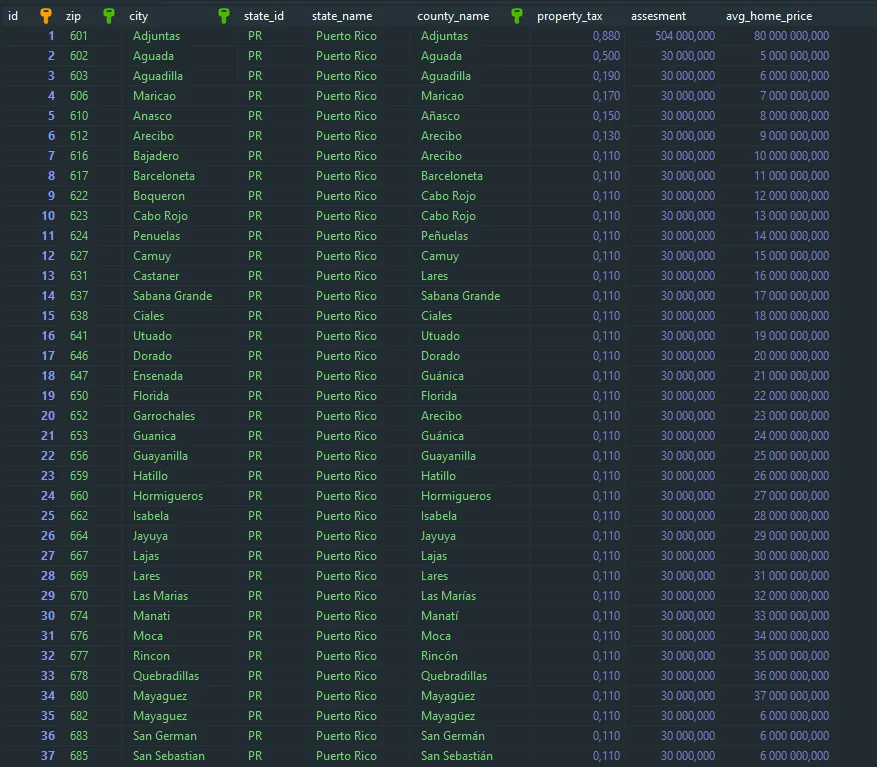

The SaaS platform expedites the co-buying process by matching viable buyers, identifying properties, securing loans, drafting co-buying contracts, and guiding buyers through every step until closing.