Nikki Merkerson, the founder and CEO of Pairgap, and I have been working since 2018 to help people buy or invest in homes together as an alternative wealth-building strategy.

Background

According to Forbes, only 47% of millennials own homes compared to 69% and 78% of the two previous generations. Millennials are strapped with student loan debt, don’t feel financially secure to get married, have lower wages, can’t save for a down payment, and currently experiencing inflation increasing. To top that, large companies continue to buy affordable homes with cash. The list goes on. Moreover, millennials miss the opportunity to build equity and grow their wealth by not purchasing homes.

Problem

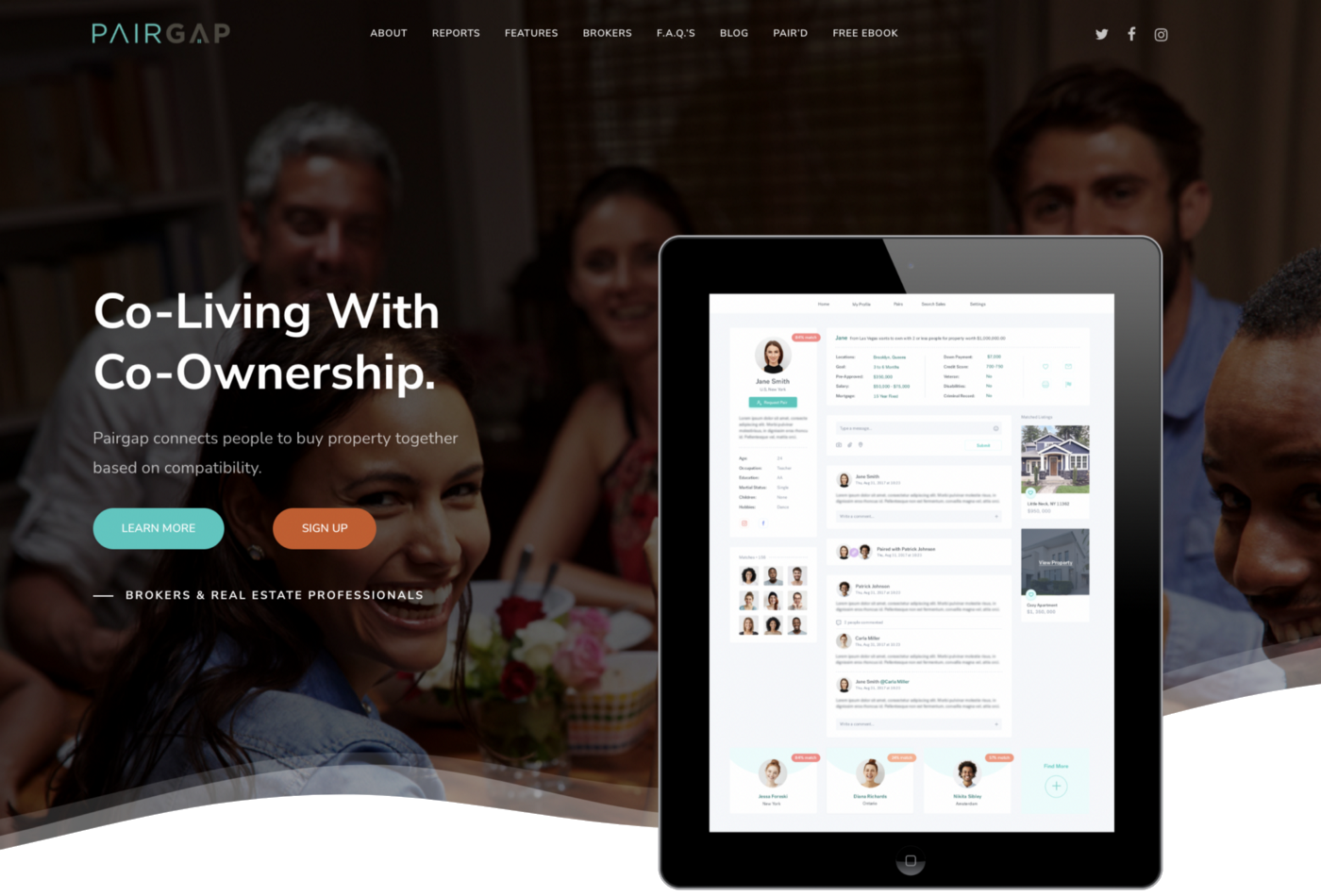

Pairgap’s mission is to close the generational gap by providing tools to guide co-buyers to invest in real estate. Many potential buyers are unfamiliar with co-buying concept possibilities and unsure about its practicality from a financial standpoint.

Solution

Through expert strategy sessions and potential buyer pairing feedback, Pairgap decided to develop a unique co-buying calculator to showcase co-buying possibilities broken down into numbers with interactive components that help users make informed decisions about potential investments.